Market Commentary ~ July 2018

Halftime Numbers

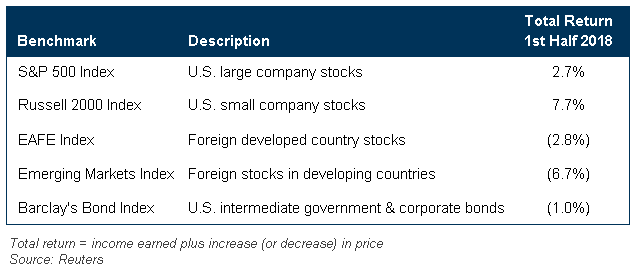

As we write in early July, major U.S equity benchmarks are 5 – 8% below record highs from January and many foreign markets are in “correction” territory. This weakness reflects concern about U.S. trade policy, higher interest rates, and a likely slowdown in corporate profit growth after 2018. First half results were lackluster for globally diversified portfolios. U.S. stocks posted positive returns while foreign market performance was negative. Bond income was offset by lower bond prices, due to rising interest rates, which resulted in a slightly negative total return.

Draining the Punch Bowl

A favorite metaphor for the Federal Reserve’s role in managing the economy involves a punch bowl and a party. Often paraphrased, the actual quote is “The Federal Reserve is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.” History can thank William McChesney Martin, Jr., Fed Chair from 1951 – 1970, for this memorable sentence from an October 1955 speech. More than sixty years later, it still resonates. Businesses, households and politicians may not like precautionary measures – such as higher interest rates – but the Fed’s job is to be the responsible adult in the room lest good economic times lead to dangerous excesses.

Jerome Powell, now in his sixth month as Fed Chairman, is in charge of Martin’s punch bowl. It won’t be removed anytime soon, but it is being drained. From a low near 0% implemented during the 2008 financial crisis and maintained through 2015, the Fed has raised its policy interest rate seven times, to a current level of 1.9%. While not “high” by historical standards, it is the direction that matters, and the direction is UP. This means higher borrowing costs for households and businesses. The bond market is discounting further increases by year-end, and the Fed wants to get short-term interest rates closer to 3% over the next few years.

Bartlett thinks higher interest rates are necessary because the economy is operating near “full employment” with very little slack. The unemployment rate is currently 4%, near an 18-year low. Meanwhile, a May report from the National Federation of Independent Business found a 34-year high in the share of small businesses raising compensation. The Fed must remain vigilant about potential inflationary pressures.

Update on Tariffs

In our last report, we opined that a “trade skirmish” was more likely than a “trade war.” This remains Bartlett’s base case, though we’re less confident now. As we noted in April, a “skirmish” is like President Reagan’s 1985 quotas and tariffs on Japanese cars and semiconductors, targeted measures that were eventually rescinded when Japanese markets became more open for American products. By contrast, a “war” calls to mind the infamous Smoot-Hawley tariffs that backfired so dismally during the Hoover Presidency, contributing to a global depression.

Much has been written about the potential impact of proposed U.S. tariffs and announced countermeasures – not just by China (which, like Japan in 1985, should make its markets more open) but by longtime allies and trading partners in Canada, Mexico and Europe. Some of the negative “first order” effects of tariffs are measurable, such as the impact of higher costs for businesses and consumers. But the less quantifiable “second order” effects – especially the influence of greater uncertainty on business and consumer confidence – can have significant economic fallout.

Our hope for eventual conciliation is partly based on the discipline imposed by financial markets. For instance, anticipated pressure on China’s economy has been a contributing factor for a 20% decline in its main stock market index. Here at home, stock prices have been comparatively resilient but somewhat wobbly amid the tariff standoff, and are 5 – 8% below January highs. Significant market declines are a bad outcome for political leaders, so this risk should give further impetus for a negotiated settlement.

Investment Implications

The key takeaway for investors is that risks are increasing. There are currently no warning signs of recession in the leading economic indicators, which have recently registered new highs and suggest a continuation of growth into 2019. But there have been eleven rising interest rate cycles since 1950 – usually referred to as “tightening” by Fed watchers – and nine of these ended in recession. History shows that stock market fallout can be severe. “Bear Market” declines of 20% or worse usually start in advance of economic contractions. Wise investors must always have appropriate safeguards in place so that market setbacks do not disrupt financial plans. The best hedges are adequate liquidity (cash and short-term bonds) for anticipated 12-18 month withdrawals, and appropriate balance (bonds and alternative investments) to control risk relative to long-term objectives. We are ever-mindful of these key investment policy criteria. Our goal is to maintain “all weather” portfolio diversification so that growth is achieved during good times while fallout from market setbacks is moderated.

Final Comments

The firm’s client retention rate for 2018 is at 99% as of midyear, and we continue to add new business at a steady pace. Do you know someone who might appreciate having Bartlett in their corner? If so, please recommend us to others who could benefit from Bartlett’s investment management and financial planning services.

Employee Highlight!

Employee Highlight!

We are excited to congratulate Holly Mazzocca, Bartlett Wealth Advisor and Principal, on passing her Certified Financial Planner (CFP) examination earlier this month. Upon meeting the necessary experience requirements, she will be able to use the CFP® designation to distinguish herself as someone who has fully satisfied the CFP Board’s rigorous requirements.

Would you like to receive the Quarterly Letter email and other Bartlett updates? Sign up here