What’s the Difference Between ETFs and Mutual Funds?

Posted on January 17, 2024

With an eye toward protecting your wealth and preserving it for the future, we act as your fiduciary stewards. By focusing on your objectives, our wealth management team develops customized, balanced portfolios designed to mitigate risk while striving to deliver consistent long-term results.

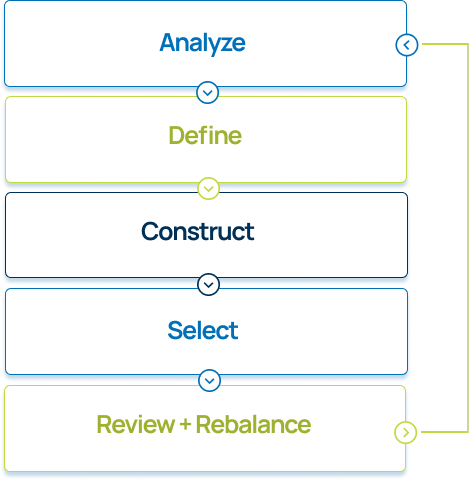

For over 125 years, Bartlett has taken a methodical approach to investing. Our team of wealth managers and research analysts work together to construct our clients’ portfolios designed to meet their unique financial needs and goals.

With a broad selection of investment offerings, we build tailored portfolios to meet your needs.

Our equity management process takes a long-term view. We focus on the proven financial performance of a company rather than on forecasts of future earnings or economic trends, prioritizing quality over flash.

Since 1983, Bartlett has had a dedicated investment team focused solely on our fixed income strategies. We actively manage both taxable and tax-exempt bond portfolios and we conduct the research and due diligence that supports the bond positions held in our clients’ portfolios.

Bartlett’s Environmental, Social, Governance Investing (ESG) offering allows individuals and organizations to invest their assets in portfolios that align with their values. Our ESG investment team engages in in-depth research to help our clients direct their assets to companies whose work and principles they believe in.

Alternative investments are opportunities outside the traditional asset classes of stocks, bonds, and cash. Our team can help clients explore investment opportunities outside of these asset classes to enhance diversification and better meet a client’s appetite for risk.

Contact a member of the Bartlett team today.