Market Commentary ~ January 2019

From Progress to Panic

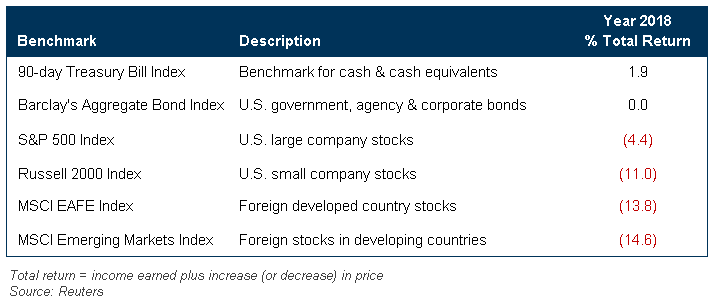

A “recession scare” swept through global stock markets in December, wiping out eleven months of moderate progress. Major indexes finished with negative performance, the most disappointing year for stock investors since 2008. Bonds posted break-even returns for the year, as interest income was offset by lower bond prices. Cash, with a modest positive return, ranked first among the major asset classes, something that last happened in 1987.

Bartlett’s Report Card for 2018

Good Grades

- As the stock market ascended to record highs during the summer, buoyed by favorable economic data, we highlighted emerging risks. Bartlett’s July report discussed the potential fallout from higher interest rates implemented by the Federal Reserve. Our October report highlighted the risk of overconfidence as measures of business and consumer optimism reached buoyant levels.

- We repeatedly emphasized safeguards necessary for prudent “all weather” portfolio management. More important, risk control was demonstrated in our portfolio transactions, which reflected a commitment to balance and careful diversification, in order to mitigate the fallout from a market setback.

- Bartlett’s recent preference for less-volatile securities helped, as most accounts posted results that exceeded benchmarks for the year. We believe losing less in bad times is critical for long-term success.

Needs Improvement

- While alert to risk, we underestimated the severity, believing occasional setbacks were probable in 2018 but a major decline (more than 10-15%) was unlikely. A year ago, in the aftermath of splendid investment returns for 2017, we opined that lower returns and higher volatility were certain for 2018 but we concluded “…a decent year is probable, featuring returns of 6-8% for stocks and 2-4% for bonds.” The December selloff moved this assessment from reasonable to overconfident.

2019 Outlook & Strategy

As we write in early January, markets remain turbulent, worries about global growth have intensified, and political controversy seems to be the new normal in the United States and Europe. The risks we identified during 2018 have manifested with a vengeance, even more than we expected. Yet, amid this growing fear and nascent pessimism, we have a more tempered outlook. While we believe important hazards are still developing in the later stages of this economic growth cycle, we think some significant headwinds are easing as well. There are also some underappreciated positives in the economic outlook.

- Foremost among “easing headwinds” is our belief that the Federal Reserve is almost finished raising interest rates. The Fed has raised its policy interest rate nine times over the last 2 ½ years. Higher borrowing costs have slowed key sectors of our economy such as housing and also impacted foreign economies that rely on American investment. An end to “Fed tightening” will help the global economy.

- The U.S. – China tariff standoff is vexing and tiring. Last year we thought the precipitous decline of the Chinese stock market, and the slowdown of China’s economy, might prompt its leadership toward concessions. We’ve been wrong so far. But now the U.S. stock market, so strong and resilient for much of last year, has sustained a major setback. We think (and hope) this will make U.S. leadership more realistic and committed to negotiate a deal. Whatever may be said of the issues – trade deficits and surpluses, intellectual property protections, etc. – we think a resolution is critical for the world economy. Fallout from the standoff is evident in near-recession conditions in major exporting countries like Germany and Japan, while many American companies are experiencing slower growth and higher costs.

- The U.S. economic expansion is long by historical standards, having started in 2009. But it has been slow until recently, so inflation excesses and major asset bubbles – harbingers of a peaking cycle – haven’t developed. Moreover, we think the corporate tax reform enacted last year is an ongoing positive for business.

Our goal is to deliver “all weather” investment performance, with growth in rising markets while fallout from significant setbacks is moderated. We don’t see an imminent return of good times such as the experience of 2017, but we think a continuing selloff is not warranted given our outlook for Fed policy and our expectation of higher corporate profits and dividends. Higher stock market volatility – rallies alternating with swoons – seems probable, so maintaining appropriate safeguards is critical. The best protections are adequate liquidity (cash and short-term bonds) for anticipated 12-18 month portfolio withdrawals, and appropriate balance (bonds and alternative investments) to control risk relative to long-term objectives. With these protections in place, good long-term investments in stocks can be maintained, minimizing the costly “behavioral penalty” of selling low after market declines.

Final Comments

We are very grateful for your loyalty and will endeavor to deserve your continued confidence. Bartlett’s client retention rate for 2018 is tracking at 96%, and we continue to add new business at a steady pace. We hope you will recommend us to family, friends, and associates who could benefit from our services.