Market Commentary, January 2015

Progress and Profits

“Defying the skeptics” is a succinct description of economic and market performance in 2014.

- The U.S. economy rebounded after a dismal first quarter, and Gross Domestic Product (GDP) increased by nearly 2.5% for the year. The American economy was a bastion of resilience amid ongoing weakness in Europe and slowing growth throughout Asia and Latin America.

- It was a good year for business. The latest estimates for S&P 500 companies show corporate profits up almost 5% for the year and dividend payments increasing by 14%.

- Labor markets improved nicely, with unemployment down to 5.8% from 6.7% a year ago.

- Inflation remained below 2%, a key factor supporting low interest rates.

What’s Next?

At this juncture, we remain sanguine about economic conditions and market potential in 2015.

- The latest updates from the Conference Board’s Leading Economic Index (LEI) indicate continuing growth in the United States. Moreover, manufacturing and service sector surveys have been consistently positive, and consumer confidence has been improving. Less clear is whether the European economy will finally gain traction and whether slowdowns in Asia and Latin America are ending.

- Although monetary policy is becoming less accommodative in the U.S., very low foreign interest rates and the outlook for subdued inflation should keep U.S. rates at historically low levels. This makes for attractive borrowing costs, fortifying business capital spending and consumer demand.

- We think equity valuations are reasonable. The S&P 500 price/earnings multiple is approximately 17 based on 2015 estimated earnings.* This is neither cheap nor expensive; it is normal by historical standards despite very low interest rates and low inflation, factors that could justify higher multiples.

- Finally, significant declines are often preceded by deteriorating technical conditions. As noted in our October update, a classic warning sign is when market performance becomes very narrow with just a few economic sectors dominating, such as when technology stocks were exalted in 1999-2000. Such a “bubbly” condition is not evident now; gains have been broadly based with most sectors participating.

* Source: Zacks Research System, January 2015

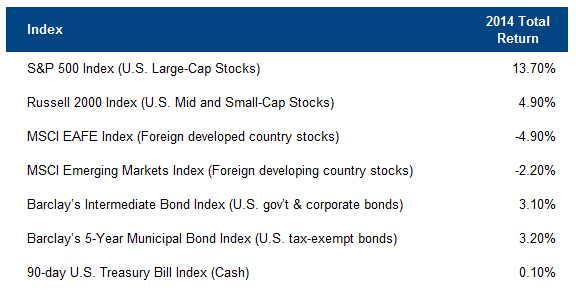

Rational Expectations

If 2008 was a “perfect storm” of all that could go wrong, the ensuing years have been a time when all the stars were favorably aligned. A steady if unspectacular economic recovery started later in 2009, with growth averaging just above 2%. Corporate profits increased at a much faster pace due to rising profit margins, reflecting both cost cutting and reduced borrowing expenses because of low interest rates. To top it off, equity valuation levels increased with the estimated price/earnings multiple rising from 13 to 17. This combination of growing corporate profits and expanding valuation levels made for handsome equity returns, with the S&P 500 Index posting a 15.4% annualized total return (growth + income) for the last five years. This is comfortably above the long-run average of 9-10%. It is very gratifying for us, given that we have steadfastly maintained higher equity allocations during the last five years. Bonds also performed well, with total returns of roughly 3.5% handily exceeding inflation and well above cash returns that have been effectively 0%.

The next five years will almost certainly bring lower investment returns. The tailwinds of falling interest rates and expanding equity price/earnings ratios are likely over. We do not expect these factors to reverse into significant headwinds anytime soon, but at best they will be neutral from current levels. This means equity performance will reflect dividend income and earnings growth, a combination totaling in the 5-7% range for U.S stocks and possibly higher for foreign equities, which have lagged during the last five years. Meanwhile, current interest rate levels suggest bond returns in 2-3% range. Cash returns will likely improve as the Fed normalizes monetary policy, but the pace of their activity suggests no better than 1-2%. We think these are reasonable expectations, grounded in realistic analysis rather than unwarranted optimism or pessimism. These expectations should, in turn, impact financial planning projections for portfolio withdrawal rates and savings strategies.

Concluding Comments

We hope you will mention Bartlett to family, friends, and associates who may benefit from our expertise and client-focused approach to investment management and financial planning.

513.621.4612 | 800.800.4612

For more information on this topic, please contact us. At Bartlett & Co, we assist high net worth individuals and their families in defining & reaching their life goals.

The material presented here was prepared from sources believed to be reliable but it is not guaranteed as to accuracy and it is not a complete summary or statement of all available data. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.