Market Commentary ~ December 2015

2015 in Review

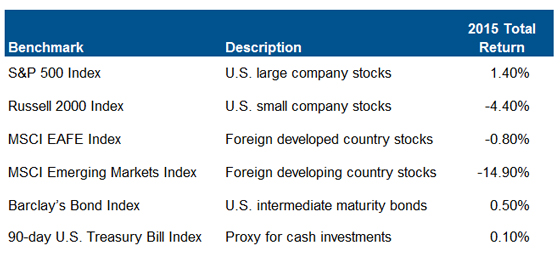

The Dow Jones Industrial Average began the year at 17,823 and ended at 17,425, this venerable index of thirty blue-chip companies showing the stagnation in U.S. equity markets. Broader U.S. and foreign equity benchmarks had similarly weak performance. Bond and cash returns remained subdued amid historically low interest rates.

Source: Interactive Data Corporation

The disappointing index results actually understate the degree of difficulty in 2015.

Stock market volatility was considerably higher.

- There were 73 days in which the market fluctuated by 1% or more, up from 38 in 2014.

- A global selloff in late summer saw the first 10% or greater decline since 2012.

The strong performance of just four stocks, the so-called “FANG” contingent of Facebook, Amazon, Netflix, and Google (recently renamed Alphabet), masked overall market weakness. An analysis by Strategas Research Partners showed the average S&P 500 stock was down 4% for 2015.

Bond markets were similarly mixed. Indexes of lower-rated corporate bonds posted negative returns, reflecting weakness in the energy and industrial sectors. Treasury Inflation-Protected Securities (TIPS), usually a safe haven, also posted slightly negative returns amid falling inflation expectations.

Prospects for 2016

Given all that transpired in 2015, it is not surprising that anxiety and worry are in abundance. In fact, the latest survey by the American Association of Individual Investors showed only 24% of respondents characterized as “bullish.” This was one of the lowest readings since 2009. But sentiment is inherently fickle and extremes often serve as contrarian signals, with caution indicated by optimism and opportunity by pessimism.

Bartlett’s assessment of key factors supports an expectation for moderate investment returns in 2016.

The U.S. economy has expanded at a slow 2.2% annual rate since recovery started in 2009. Our analysis of leading indicators makes us believe growth is likely to continue in 2016. While the pace of progress may be disappointing, we are mindful that a slowly growing economy does not build the excesses – such as inflation and overproduction – that often precede recessions.

Much has been written about falling oil prices, viewed by some as a harbinger of economic trouble. However, history shows that rising oil prices – not falling – frequently cause recessions. The immediate impact of lower prices has been negative because of significant cutbacks in capital spending by energy companies. However, reduced fuel costs for households should support consumer spending in 2016.

Many economists are worried about fallout from slowdown in China and anemic growth in Europe and Asia. Some believe these overseas difficulties will drag down the U.S. and provoke a global recession. Bartlett acknowledges these challenges will be an ongoing headwind, especially for export markets. However, global recessions have historically started with the U.S., which is not surprising given the size of our economy. So we think the more likely scenario is continued moderate global growth.

Intermediate and long-term interest rates are likely to remain low, notwithstanding the possibility of a few more increases in the Fed’s short-term policy rate. We think the key factors here are continued low inflation, very low interest rates in Europe and Japan, and the strength of the U.S. dollar.

Equity valuations seem reasonable given low interest rates and low inflation. The S&P 500 Index is valued at approximately 15x projected earnings for 2016 based on the latest data from Bloomberg. Moreover, many quality stocks provide dividend yields that exceed the yields provided by quality bonds, and also have potential for dividend increases.

While markets have been chaotic so far in January, we do not believe an economic recession is imminent and we think tightening of monetary policy will be very gradual. Nevertheless, we will be vigilant in monitoring these very important factors, for we are keenly aware that the economic recovery is now in its seventh year, making it among the longest in U.S. history. For now, it seems reasonable to expect positive equity returns for the year, perhaps in the 4-8% range, albeit with higher volatility and occasional corrections. Bonds should be comparatively stable with returns of 2-3%, while cash yields should remain below 1%.

Bartlett will continue to navigate with careful value-based strategies, grounded in realism rather than optimism or pessimism. This should protect us from the behavioral penalties caused when decisions are driven by emotion, which can manifest in hazardous practices like “market timing” and “performance chasing.” These impulses can be especially seductive and dangerous now, given higher volatility and numerous uncertainties following a disappointing year for financial markets. We will endeavor to make sure market turbulence does not disrupt clients’ financial plans. Timeless principles – setting realistic goals, maintaining appropriate asset allocation, avoiding market timing, diversifying broadly, and rebalancing periodically – will be our guideposts.

Concluding Comments

We are very grateful for your trust and honored by your confidence. Bartlett accomplished steady client additions throughout 2015 and a 99% retention rate for existing business. We hope you will recommend us to clients, friends, and colleagues who may need our investment management and financial planning services.

The material presented here was prepared from sources believed to be reliable but it is not guaranteed as to accuracy and it is not a complete summary or statement of all available data. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.