Market Commentary ~ April 2018

From Tranquil to Turbulent

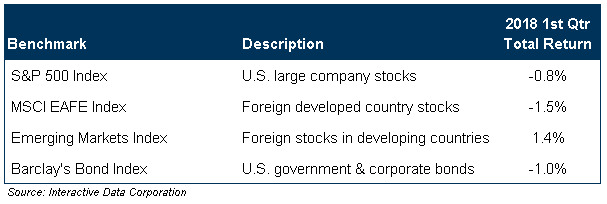

After steadily rising for more than fourteen months, the U.S. stock market experienced a reversal amid much higher volatility during the first quarter of 2018. As we write in early April, many equity benchmarks are 7-10% below highs recorded in January. First quarter results were generally lackluster.

Positives and Negatives

Updating and expanding our watch list from the January letter, we address a smorgasbord of factors, beginning with comments on two very recent developments.

Tariffs

Global equity markets sold off during March after President Trump imposed tariffs on steel imports and on selected Chinese imports. We think media coverage has been somewhat sensational. Bartlett sees this as a “trade skirmish” rather than a “trade war.” We don’t like tariffs but we believe this is not the start of “Smoot-Hawley” protectionism reminiscent of the Hoover Presidency. Instead, it seems like prior episodes of targeted economic brinksmanship. President Reagan imposed import quotas on Japanese cars and high tariffs on Japanese semiconductors, which were later lifted, and the second President Bush briefly imposed steel tariffs.

We recognize the situation is evolving and impacted countries are developing countermeasures. As of this writing, the negative economic fallout seems moderate, more than offset by stimulation from corporate tax reform.

Technology & Regulation

We dutifully pay utility bills to assure continued access to water and warmth. But we get no invoices for other conveniences of modern life: online shopping, instant information, communications, photography, and much more. Alas, these are not “free.” Technology companies – Amazon, Google and Facebook to name a few – make money by selling user data (i.e. what we’ve been searching for, reading, viewing, buying and sharing) to companies that use it in marketing goods and services. We pay for extraordinary convenience through the hidden cost of less privacy. This sometimes vexing tradeoff is now getting intensified scrutiny; Congressional hearings on technology and privacy will be underway soon.

As we write in early April, technology stocks have sold off, and many are 10-15% below recent highs. This is important because technology is the largest sector of the U.S. market, populated by innovative companies that have achieved exceptional business growth. Any new regulations of social media and related technologies may reduce growth potential for some companies. Regulatory and legislative uncertainty could provoke more market weakness.

Market Volatility

Simply put: get used to it. The “cruise control” conditions of 2017 were exceptional; what we have experienced in 2018 is more normal. History shows that 5% market setbacks occur about three times a year, and 10% corrections roughly once every 12-18 months. The recent market correction was the first meaningful decline since early 2016.

Global Economic Growth

The U.S. Index of Leading Economic Indicators recently registered another new high, and this augurs continuing expansion at home. Moreover, the rate of growth is improving. Data from Europe and Asia is similarly encouraging, indicating synchronized global economic growth for the first time in a decade. We find no “recession warnings” at this juncture.

Corporate Profits and Dividends

U.S. corporate profit growth in 2017 was above 10%, the strongest rate of improvement since 2011, and the growth outlook is even better for 2018. We anticipate very robust dividend increases as well.

Inflation and Interest Rates

A move up to 2-3% inflation seems likely over the next year. This is why the Federal Reserve is transitioning to higher interest rates. These higher rates can negatively impact stocks in two ways. Borrowing costs go up for businesses and consumers, lowering economic potential. Meanwhile, prospective bond returns become more competitive, reducing the appeal of stocks.

Stock Valuation Levels

The S&P 500 price/earnings multiple for 2018 is somewhat above the post-WWII average of 15-16, though arguably reasonable relative to interest rates and inflation. However, longer-term measurements of valuation, based on a full economic cycle, put stocks in more elevated territory, indicating risk when the next recession occurs.

Outlook & Strategy

In our January report we opined “After a remarkably steady year in 2017, we think higher stock market volatility (occasional 5-10% setbacks) is almost a certainty for 2018.” The interplay of factors discussed in this report, some positive and others negative, makes us anticipate continuing turbulence. But we believe a major “bear market” selloff is unlikely given the favorable outlook for the economy and corporate profits.

The best hedge against volatility is to keep appropriate liquidity (cash and short-term bonds) for anticipated withdrawal needs and appropriate balance (bonds and alternative investments) to control risk relative to long-term objectives. With these critical safeguards in place, occasional setbacks will not disrupt financial plans. While still optimistic, we are on the lookout for excesses in economic and market conditions. We are mindful that this growth cycle started in 2009, when conditions were grim, and we know stock markets usually peak when business conditions are favorable.

Final Comments

Bartlett is striving for another year of 98% (or higher!) client retention in 2018. We are grateful for your loyalty. We hope you will recommend us to family, friends and associates who could benefit from our services.