Market Commentary ~ October 2019

Satisfying Progress

By any measure, 2019 has been a good year for investors so far, defying many skeptics. Rising corporate profits, increasing dividend payments and declining interest rates have been a favorable combination. Major asset classes are near record levels, with U.S. stocks in the vanguard of performance.

Positives and Negatives

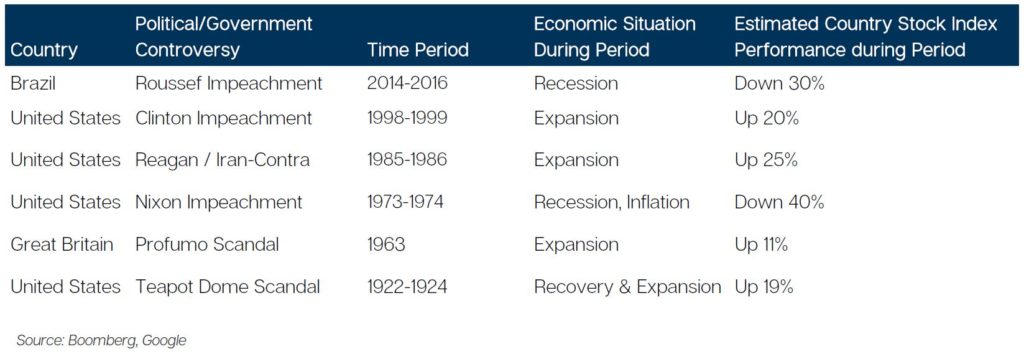

As we write in early October, an impeachment inquiry is underway. It is timely to revisit how political controversy impacts financial markets, a topic we addressed two years ago in a July 2017 report. As detailed below, turmoil did not depress stocks during periods of growth. However, fallout was considerable when the economy was deteriorating.

It seems best to reserve judgment on the impeachment inquiry. Time will tell if there was significant wrongdoing. At this juncture, moderate growth seems likely to continue in the U.S., keeping the global economy in expansion mode despite tepid performance in Europe, BREXIT uncertainty in the U.K., and slowing growth in Asia. Inflation is low and interest rates are at accommodating levels for housing and capital spending.

Seatbelts Fastened

The current economic growth cycle is now the longest expansion in U.S. history. It started more than ten years ago, when a severe recession finally bottomed out in 2009 following a global financial crisis. It has been a slow expansion by historical standards, certainly fragile at times, with many challenges along the way. Economic progress was nearly sidetracked in 2011 during the European currency crisis and again during late 2015 and early 2016, a memorable time when oil prices crashed and China devalued its currency. The ongoing trade stalemate with China has been the latest challenge. The U.S. economy has been resilient thus far. However, weakness in export-oriented economies, such as Germany, is also manifesting in the American manufacturing sector.

We don’t need complicated analysis to recognize the growth cycle is in a later stage. This means hazards are increasing and risk management is increasingly important.

Preparation vs. Prediction

Forecasting the timing and duration of a downturn is almost impossible with any precision, so we think a prudent strategy is based on preparation rather than prediction. The goal is not to make major investment changes based on predicted market fluctuations – we believe this is tantamount to “market timing” – but to recognize the inevitability of market turbulence and make sure it does not disrupt financial plans.

- Based on history, a few 5% market declines are likely during the next year. One of these could be the early stage of a 10% setback, a so-called “correction” that happens about once a year. For those relying on portfolio distributions, withdrawal needs should be provided by a combination of cash, anticipated dividend and interest payments, and maturing short-term bonds. This limits any fallout from a stock market decline.

- More significant “bear market” declines of 20% or worse usually begin at the outset of recessions. The 2008 decline was so severe that it took three years for stock prices to fully recover to the previous high recorded in late 2007. Major downturns are dangerous for the unprepared, if eventual distribution requirements necessitate stock sales when prices are low. The best protection is to have adequate lower-risk bond and alternative investments, a contingency that should protect against selling stocks at inopportune times over a 2-4 year planning horizon.

- Even for those investing primarily for long-term growth, with no anticipated distributions, a prudently diversified portfolio should now include lower-risk assets. Such a portfolio will hold up better in difficult times. Furthermore, it will allow the potential to rebalance (i.e. adding to stocks) if adversity results in lower prices, so that market selloffs can be periods of opportunity rather than peril.

- Our investment selections have recently emphasized more conservative securities that we expect to hold up comparatively well when a significant setback occurs. This approach was “stress-tested” in 2018 when a severe global stock market decline happened during the fourth quarter. While not bulletproof, our investment performance results held up relatively well in a down year. While sometimes underappreciated, resilience during adversity – losing less during market declines – is a vital factor for successful long-term investing.

Concluding Comments

We are honored by your confidence and privileged to serve you. Bartlett is steadily adding new clients while maintaining a 99% retention rate for existing business. We hope you will recommend us to family, friends, and colleagues who need a trustworthy partner of fiduciary caliber for their financial planning and investment management.