Market Commentary – July 2020

Rising Markets and Pervasive Worries

As of midyear, equity markets have rebounded by almost 40% from lows reached in

March, with U.S. “blue chip” stocks in the vanguard of performance. This

resurgence means larger company benchmarks are only 4% below levels that

prevailed at the outset of the year, while indexes of smaller company stocks

and foreign stocks are 10-15% lower for the year. Bond prices have also

increased to levels near all-time highs with yields near historic lows.

The stock market recovery has aroused plenty of skepticism. Much has been written about a disconnect between rising stocks and challenging economic conditions, which many believe should be reconciled by a renewed market decline. There is also concern that aggressive government stimulus will eventually provoke higher inflation.

Making Sense of the Recovery

History shows that stock prices and economic performance are rarely synchronized. The former almost always leads the latter. For instance, during the financial crisis and recession of 2007-2009, the stock market bottomed out in March 2009. This was six months before the recession ended and a year priorto the unemployment rate finally peaking in early 2010. Similar patterns manifested in prior business cycles, with stocks rebounding in advance of economic upturns following recessions in 2001, 1990, 1982 and 1974. This is why it is difficult to “time” the stock market. Bartlett believes “time in the market” is much more impactful than “market timing” for patient, long-term investors.

There are no rose-colored glasses at Bartlett. We think the economy is improving but full recovery will take longer than usual. We also recognize factors that could provoke renewed pessimism, such as rising infection rates and elevated political tension in a contentious election year.

As for inflation, we think it may eventually trend higher, but we believe it won’t be dangerously high anytime soon. The aggressive lockdown measures were a major deflationary shock to the economy, with unemployment quickly rising from only 3.5% in February (lowest since the late 1960s) to nearly 15% in May (highest since the Great Depression). It may take at least 2-3 years of job growth to absorb this huge excess capacity.

Stocks and Bonds

President Truman quipped that history doesn’t repeat itself, but it often rhymes. So it is that we revisit factors discussed in our July 2012 commentary. Eight years ago, we were writing amid skepticism about the sustainability of a stock market rebound from crises in the US and Europe. It was, like today, a period of very high market volatility amid worldwide economic uncertainty and rising political polarization in an election year. The market conditions we described then are evident again today.

- U.S. Treasury yields are currently near 70-year lows, back to levels that prevailed shortly after the conclusion of WWII. The buyer of a 5-year Treasury note gets a mere 0.3% yield, a 10-year bond provides only 0.7% and a 30-year bond yields just 1.4%. The dividend yield for the overall stock market, measured by the S&P 500, comfortably exceeds these Treasury yields.

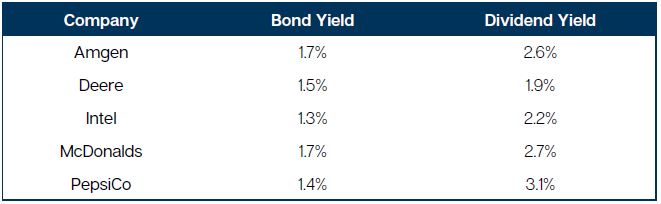

- More significant is the attractiveness of equity investments when we compare stocks and bonds (maturing in 5-10 years) issued by the same company. A few examples are highlighted below.

In every case, the dividend yield exceeds the bond yield, which is uncommon. Stocks usually yield less than bonds; the equity investor accepts a lower income in exchange for growth potential. Today the equity investor can get the head start of a higher income, along with any ensuing growth. While pessimists would doubt both growth and the security of dividends, we think these and other great companies should have materially higher profits and dividends over the next ten years, just as their current business results are well above levels of a decade ago. This means the total return (income + growth) potential of many stocks is favorable compared to fixed income securities.

Investment Outlook and Strategy

Careful balance and thoughtful diversification are the foundations of our portfolio strategy. We know it is so critical to assemble quality portfolios that will be maintained when markets get challenging. This helps our clients avoid the costly “behavioral penalty” of selling at low prices during occasional market shakeouts. We continue to emphasize quality large company stocks, many featuring solid and rising dividends, in keeping with our “all weather” goal of participating well in strong stock markets and holding up well in difficult periods. While patiently maintaining existing positions, we are alert for opportunities created by market turbulence, which may allow us to add stocks we previously deemed overvalued. As for bonds, Bartlett’s mindset is definitely “safety first.” This means a bias favoring quality bonds with shorter to intermediate maturities. Notwithstanding low interest rates, quality fixed income securities are a vital safeguard for balanced portfolios. We think money market yields will remain near zero throughout the next few years, but appropriate cash reserves are always necessary, especially for anticipated withdrawals.

Concluding Comments

Bartlett is accustomed to market turbulence, but we know it is unsettling for many people. Come what may, we will carefully apply time-tested strategies, endeavoring to provide solid and durable long-term performance.

We are very grateful for your business, a responsibility we cherish at all times but especially now as we navigate unusual challenges. We hope you will recommend Bartlett to family, friends and colleagues who could benefit from our financial planning and investment management services.

We wish you a safe, healthy, happy and fulfilling summer!