Market Commentary ~ January 2020

Proper Perspective

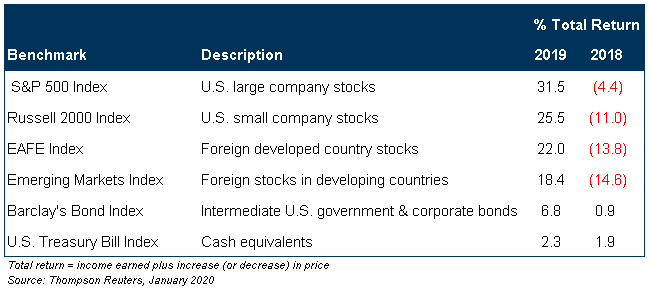

By any measure, 2019 was terrific for investors. Stock and bond returns were buoyed by continuing economic growth, low inflation and declining interest rates. 2019 results are summarized below along with outcomes for 2018, a down year that climaxed with a major selloff in December. As Bartlett was not downcast after 2018, we are not unduly exalted by 2019. We are always mindful that investing is a marathon, not a sprint.

Navigating the Noise

Global equity markets encountered meaningful turbulence during 2019, with notable declines in May and August. These selloffs aroused typically sensational media coverage including dire prophecies of continuing distress. Bartlett addressed prevailing worries in quarterly commentaries. In our April report we countered recession fears aroused by an inverted yield curve and in October we offered a historical perspective on political controversy. At other times in the year, setbacks were provoked by a continuing U.S. – China tariff stalemate and money market disruptions. These occasional shakeouts can tempt “market timing” which has a seductive appeal for many when stock prices are declining. But results for 2019 remind us that “time in the market” rather than “market timing” is the most important factor for long-term investors.

It’s reasonable to expect a few setbacks in 2020. With appropriate portfolio safeguards in place, occasional selloffs will not disrupt financial plans and can be periods of opportunity rather than peril. Bartlett will remain focused on careful asset allocation, prudent diversification, and security selection based on realistic business and valuation assessments. These are timeless principles that help us achieve our goal of “all weather” performance, doing well in rising markets like 2019 while holding up better in down years like 2018.

Forecasting Season

It wouldn’t be a new year without annual Wall Street forecasts! Economic and stock market predictions are as ubiquitous as dandelions in springtime. But even if we could precisely gauge the economy and corporate profits in 2020, it does not assure an accurate stock market assessment.

Looking back at results for 2018 and 2019, the former a famine and the latter a feast, many might be surprised to learn that economic growth and corporate profitability were actually stronger in 2018. The swing factor was the trend of interest rates. This was a headwind for stocks in 2018 when rates increased because improving growth aroused inflation concerns, but then became a tailwind in 2019 when rates declined after the Federal Reserve recalibrated monetary policy.

What’s in store for 2020? The Federal Reserve is aiming for steady interest rates, but this is no guarantee. A year ago, The Wall Street Journal surveyed 69 economists about interest rates. As it turned out, all 69 were wrong! This reminds us of the saying about two types of forecasters: those who don’t know and those who don’t know they don’t know.

Managing Risk

While economic forecasts are taken with a grain of salt, objectively assessing data makes us aware of emerging risks.

Low interest rates, though mostly favorable, have created some dangerous excesses. Low borrowing costs have encouraged “financial engineering” whereby some companies borrow to finance higher dividends and stock repurchases at levels not supported by profitability. This may provide instant gratification for certain constituencies, such as activist shareholders, but it is not the good stewardship we expect from well-managed companies. Low borrowing costs have also stimulated housing demand, and there is evidence that home prices, relative to inflation, are returning to excessive levels reminiscent of 2006-2007. While the companies we favor are conservatively financed, we know eventual fallout from too much corporate debt or less rosy housing markets will have ripple effects impacting even strong businesses. This means rebalancing, more defensive stock selection, and careful cash management are priorities for 2020.

Rebalancing is now a risk-management priority. A portfolio having a 70% stock allocation a year ago would today be near 75%. It is a good time for careful fine-tuning, selectively reducing stock positions at high prices and reinvesting in lower-risk fixed income and alternative investments, so as to restore asset allocation targets and control risk.

The U.S. economic growth cycle, now exceeding ten years, is the longest in history. In the later stages, we favor companies with less economic sensitivity, very strong finances, and “value” characteristics such as solid dividends and moderate price levels relative to earnings and cash flow. These stocks should hold up better in a market setback.

Mindful of occasional market disruptions, a perennial “to-do” list item is keeping liquidity – cash, dividend and interest income, and bond maturities – sufficient for anticipated withdrawals. Short and intermediate maturity bonds should be at levels consistent with longer-term distribution requirements. These safeguards, carefully maintained, will protect against the need to sell stocks at lower prices during market setbacks.

Concluding Comments

We are honored by your confidence and privileged to serve you. Bartlett finished 2019 with client retention above 98% and steadily added new clients during the year. A special highlight was adding an office in Chicago. In addition to this growth, five professionals joined us during 2019. We welcomed another Chartered Financial Analyst (CFA) to fortify portfolio management and four Certified Financial Planners (CFP) to enhance our planning capacity. We hope you will recommend us to family, friends, and colleagues who need help with financial planning and investment management.