Market Commentary ~ September 2016

Defying the Skeptics

U.S. and foreign equity markets performed well during the third quarter. Stocks were buoyed by modest economic growth, tame inflation, and low long-term interest rates. Bonds also delivered positive returns. This progress put major investment benchmarks in positive territory for the year-to-date, as detailed below.

We are very pleased by this progress because our recent commentaries anticipated economic and market resilience. Our perspectives were a counterpoint to the worries following the “BREXIT” vote in June, and the recession fears that prompted a chaotic selloff at the start of the year. We are especially encouraged that growth has been broadly based this year, with many stocks on the upswing, because more narrowly focused market returns (i.e. technology in 1999) usually signal dangers ahead.

Good Behavior

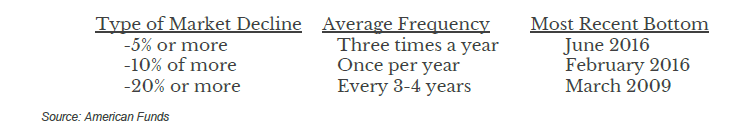

A recurring theme in Bartlett commentaries is the importance of removing emotion from investing. This is vital now, because higher market volatility can be frightening but must be put in proper perspective. The statistics summarized below are based on more than a century of data for the Dow Jones Industrial Average.

Bartlett has always advised against making major portfolio changes based on occasional 5-10% fluctuations. It would require excellent timing to sell and repurchase at the right intervals. A much more significant consideration is whether a “bear market” decline of 20% or worse is probable, in which case some defensive measures (reducing stocks) would be considered. We find that most significant market setbacks occur due to some combination of economic recession and/or significant interest rate increases. These events seem unlikely during the next year, given our ongoing assessment of a wide variety of factors, so we believe a major decline is not probable. However, there could be more spasms of 5-10% magnitude. These will invariably be sensationalized by the media. With appropriate safeguards in place – thoughtful asset allocation, careful diversification, and cash reserves for withdrawal requirements – Bartlett views these dislocations with equanimity, and looks for opportunities to upgrade into securities that were previously too high-priced.

Coming Soon: The 45th President

“Stronger Together” and “Make America Great Again” are typically banal slogans for an election year, but most Americans will wake on November 9th with feelings of “At Least It’s Over.” When was the last time a Presidential election featured daily character assassination, a general lack of substance, and two more widely-ridiculed candidates? While mudslinging is a staple of political campaigns, this one does seem especially dismal.

Similar to past cycles, both sides warn about the horror of an opposition victory. Our outlook is less emotional. The wide variety of legislative and judicial checks and balances in our system – an enduring legacy from our Founding Fathers – assures that change will be evolutionary rather than revolutionary. For instance, we think the likely composition of the next Congress makes individual tax increases very unlikely in 2017. Long-overdue reform of corporate taxation is possible and could improve the economic outlook, along with increased infrastructure spending that could attract bipartisan support.

The outlook for interest rates and corporate profits will remain of paramount importance, and this is where most of our attention will be focused.

Concluding Comments

We are honored by your trust and feel privileged to work for you, especially during bouts of market turbulence when we most appreciate your confidence. Please recommend Bartlett to your family, friends, and colleagues who are seeking a trusted resource for their investment management and financial planning needs.