Market Commentary ~ September 2015

Stocks in Reverse

Equity markets soured in the third quarter with declines in all categories. Falling stock prices paralleled a downward reassessment of the global economic outlook amid lackluster growth, minimal inflation, and a chaotic selloff in China’s stock market. Investor sentiment was also compromised by less measurable factors. For instance, recent political developments confirmed that polarization and stalemate seem to be a “new normal” for Western governments. Meanwhile, Russia’s military intervention in Syria was the latest manifestation of rising geopolitical tensions. Quality bonds were a safe haven amid the turbulence, providing positive returns.

Source: Interactive Data Corporation

Barring a significant rebound, we may finish with negative equity returns for the year, as measured by the S&P 500 Index. While disappointing, this is not unprecedented. It has happened fifteen times since 1945.

Are We in a Bear Market?

Market corrections are inevitable. There have been fourteen setbacks of 5% or greater during the last six years, and at the low point in August this latest measured 12%. Bartlett has always advised against making major portfolio changes based on short term fluctuations. It requires almost perfect timing to sell and repurchase at the right intervals, and the drag from taxes and transaction costs can be meaningful.

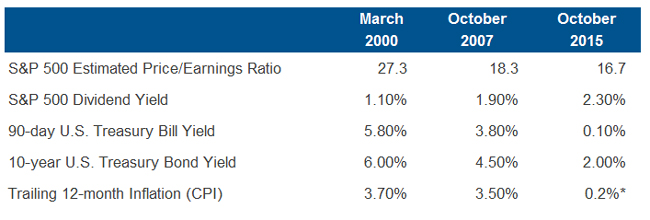

A more significant consideration is whether a major bear market is underway, comparable to experiences in 2000-2002 and 2008. We think a major selloff is unwarranted and unlikely. The most important factors are that equity valuations are more attractive, and interest rates and inflation much lower, compared to levels that preceded these prior bear markets. A comparison of key measurements follows:

Sources: Bloomberg, Zacks Research System, Bureau of Labor Statistics

* As of August 31, 2015

Major declines often occur when the Federal Reserve is tightening monetary policy, especially when significant interest rate increases are implemented to counter rising inflation. This seems unlikely anytime soon. We also know that bear markets usually happen before and during recessions. While the U.S expansion that started in 2009 has been slow, leading economic indicators augur continued moderate growth. Improving labor markets, higher home values, and low interest rates are key positives. We recognize that many foreign economies are fragile compared to the U.S., which is restraining global growth and the ability of multinational companies to achieve higher revenues and profits.

In addition to quantifiable factors, we have seen no evidence of dangerously high investor confidence usually prevalent before significant market peaks. There have been isolated valuation excesses in the last year – social media companies and biotechnology stocks – but nothing resembling the “New Economy “ euphoria over technology in early 2000 or the overconfidence about housing in 2007. It is these very extremes – if embraced – that can be lasting threats to wealth.

Navigating Volatility

Bartlett emphasizes appropriate portfolio safeguards so that market setbacks do not disrupt clients’ financial plans. This is reflected in prudent asset allocation, careful diversification, and investment selections based upon realistic assessments of value. Less volatile holdings – bonds, cash, and alternative investments – remain a vital component of balanced accounts, providing income and safety for those with regular withdrawal needs and lower risk tolerance. With appropriate policies in place, the well-prepared can view market dislocations with equanimity, seeking opportunities to upgrade into securities that were previously too high-priced.

Concluding Comments

Bartlett was featured in the September issues of Fortune, Bloomberg Business Week and Money magazines. Enclosed is a copy of the article for your review.

We are very grateful for your trust and honored by your confidence. Bartlett is doing well, with steady new client additions and a 99% retention rate for existing business. We hope you will recommend us to family, friends, and colleagues who may need our investment management and financial planning services.

The material presented here was prepared from sources believed to be reliable but it is not guaranteed as to accuracy and it is not a complete summary or statement of all available data. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results.